Custom ICHRA health plans with Thatch

ICHRA (Individual Coverage Health Reimbursement Arrangement) is a customizable, flexible, and personalized health benefit that allows employers to reimburse employees for their health insurance premiums and medical expenses.

Why businesses are switching to ICHRA with Thatch

Say goodbye to rising premiums and inflexible coverage. ICHRA gives your company a smarter way to offer healthcare — one that adjusts to your budget and your workforce. Thatch helps you launch fast, stay compliant, and deliver benefits that scale with your business.

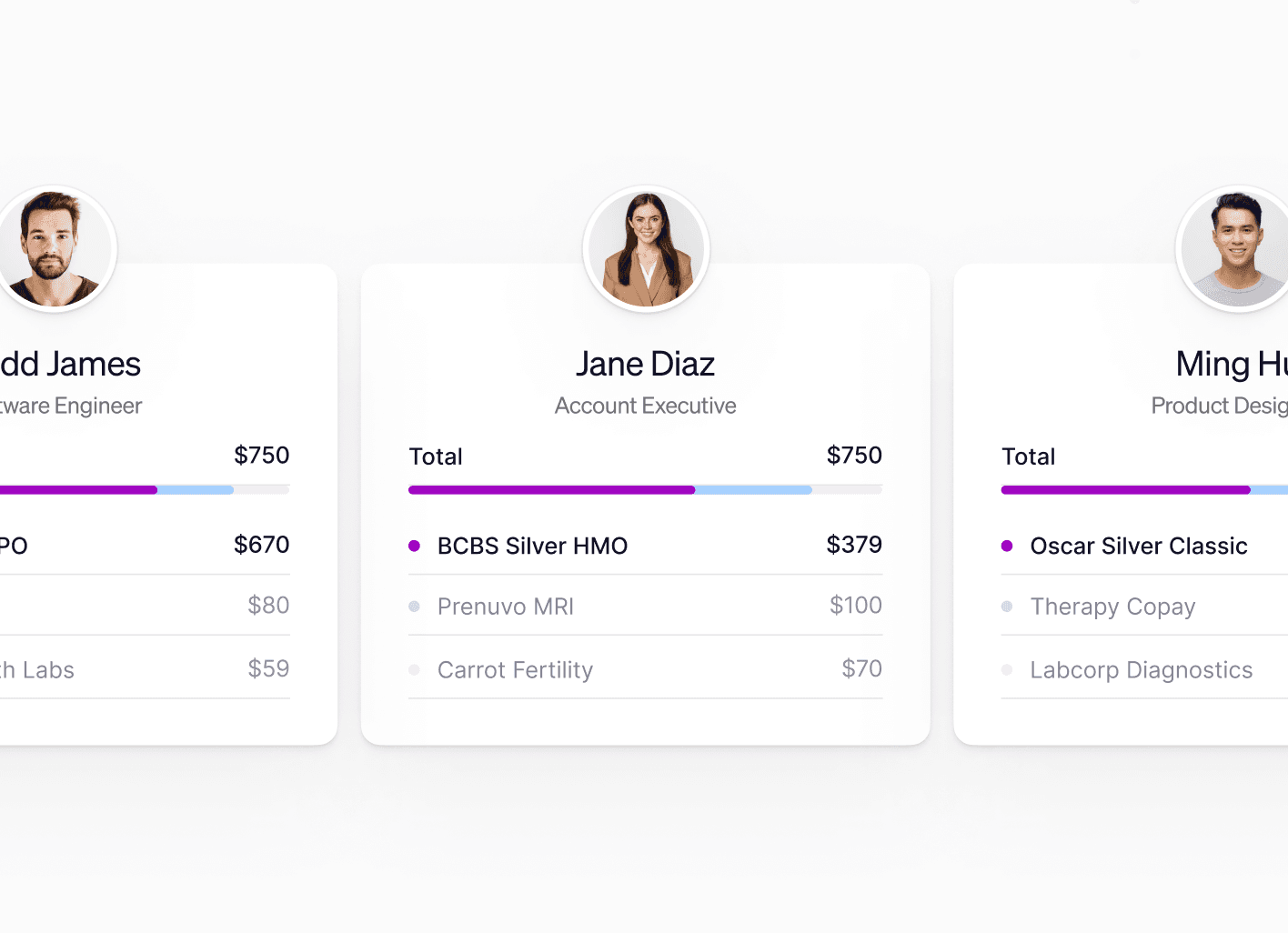

Tailored benefits for every team — From HQ to remote

Different roles need different benefits. With Thatch, you can segment employees by team, location, or status — and assign budgets that match their needs. Whether you’ve got remote workers, part-timers, or multiple offices, we make benefit customization simple and scalable

ICHRA reporting guide

ICHRAs come with compliance and reporting requirements that employers need to be aware of, including ACA, PCORI, ERISA, and Medicare Part D reporting. This ICHRA guide breaks down these obligations and shows how Thatch streamlines the process, making it easier for employers to stay compliant.

Calculate monthly healthcare budget

$545

Employee

$845

Employee + 1

$1145

Employee + 2 or more

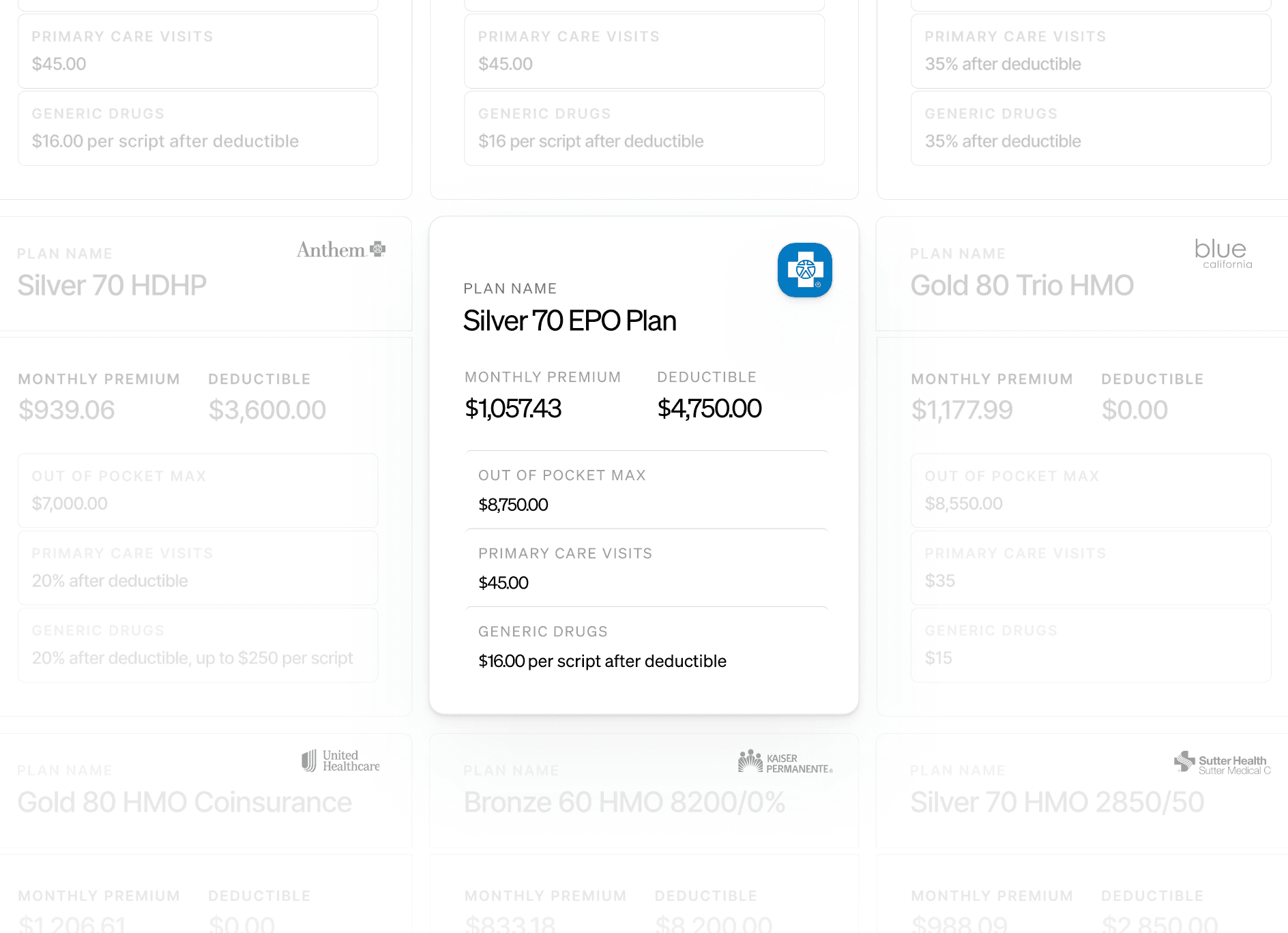

ICHRA vs group plans

Traditional group plans are costly, rigid, and hard to manage. With ICHRA through Thatch, you set the budget, give employees choice, and eliminate the insurance admin from your to-do list. It’s health benefits — upgraded for today’s teams and budgets. Explore more here.

ICHRA | Group Plans | |

|---|---|---|

Cost Control Set a defined budget for each employee to avoid annual rate hikes | ||

Ease of Administration Shift administrative burden to the individual insurance companies | ||

Participation Flexibility Avoid minimum participation requirements | ||

Customization Employees can select a plan that aligns with their specific healthcare needs | ||

Employee Empowerment Employees can use leftover funds for other healthcare expenses |

We make ICHRA easy — You stay in control

ICHRA is a powerful tool — but only if it’s managed well. That’s where Thatch comes in. We take care of setup, plan selection, reimbursements, compliance, and support. You stay focused on your team, while we deliver a seamless benefits experience in the background.

Save money while providing better benefits

Most employers using Thatch save money with ICHRA compared to group health plans. ICHRA lets you set tailored allowances for each employee, preventing overspending in some markets and underspending in others.

Calculate monthly healthcare budget

$545

Employee

$845

Employee + 1

$1145

Employee + 2 or more

ICHRA frequently asked questions

Unlike group health plans, ICHRAs can offer tax advantages for both employers and employees, streamline administration, and potentially increase employee satisfaction by providing more personalized health coverage options. See ICHRA vs Group Plans for a longer write-up on ICHRA vs group health plan.

Create the healthcare experience your employees deserve

Thatch works for companies of all sizes and takes minutes to set up.